Hi Seb,

In response to the idea of separating the catalog into multiple collections and only submitting a few to a SIP like this one:

That was actually an approach I seriously considered when drafting this SIP. You can even see it referenced in Slide 2 of the presentation, where I initially separated the collection from the liquidity aspect.

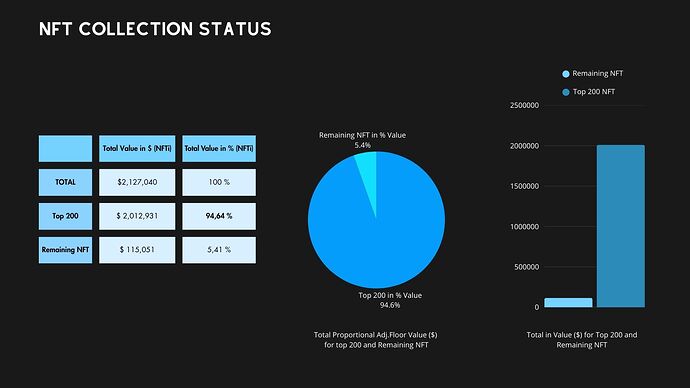

However, after evaluating the pros and cons, I concluded that this would add unnecessary complexity and could potentially create negative outcomes. It might lead to a situation where it’s only worth going through the entire vesting process for a few high-performing collections, leaving the DAO stuck with low-value, illiquid assets that no one wants to handle.

Consider the process we’re already going through: several weeks of preliminary discussions with the DAO team, two weeks in the SIP idea phase, another two weeks of active discussion, then two more weeks of voting. Even after that, it’s unclear how long it would take to actually kick off operations. Plus, there’s a mandatory three-month freeze before submitting another SIP.

On top of that, we still need to build the internal framework from the ground up to manage operations on the custodial wallet. That’s covered in Section 1 of the requested budget. Splitting collections across multiple SIPs would reduce the flexibility we need to respond to market dynamics effectively, and that kind of agility is essential in this space.

That said, I’ve seen proposals aiming to streamline the SIP process in the future, and I think those initiatives are promising. Combined with our end goal of leaving the DAO with a curated portfolio of a few hundred performing assets and a solid operational framework, this would allow the DAO to manage its holdings fully independently.

Of course, I expected this to be a topic of debate. DAO members have different perspectives, and in some cases, personal ties to certain projects. Others might simply lack experience or insight into the NFT collectible or digital art markets. That’s entirely fair, and it’s why I believe open discussion and long-term thinking are so important here.

In response to the idea that our remuneration could simply be indexed to results:

What I was pointing out in that paragraph is that the acquisition budget is calculated as:

Acquisition budget = Liquidation revenue – Quarterly cash out

and not

Acquisition budget = (Liquidation revenue – Quarterly cash out) – Remuneration

As you know, SIP budgets are vested by the DAO treasury itself. This structure means that our remuneration is part of a broader operational budget and not directly derived from the liquidation proceeds.

Making the entire remuneration variable wouldn’t be fair, particularly in regard to the work outlined in Sections 1 and 4 of the proposal. Those deliverables are independent of liquidation outcomes and are scheduled to be completed either before or after any transactional activity occurs.

To provide some perspective, in traditional art market practice, when I manage the liquidation of a collection, I typically receive 8% before tax on sales from the vendor if the collection is auctioned. That fee covers cataloging, valuation, strategic advice, and operational oversight. The auction house itself takes an additional 5% to 12% from the seller, and around 30% from the buyer. These fees drive the hammer price down compared to private sales, and since all those costs are passed on to the buyer, it impacts my commission as well — similar to how a tariff works.

In private sales, the commission is usually degressive, based on the value of the individual work:

- 30% for €1–10K

- 25% for €10–50K

- 20% for €50–100K

- 10% for €100–300K

- 7% for €300–600K

- 6% for €600K–1M

- 5% for €1M+

But I don’t think this kind of structure translates well to the DAO context, considering the nature of the project and how funds are managed.

I’ve spent a lot of time trying to come up with a variable income model that would make sense for this mission. I couldn’t find one that wouldn’t create adverse incentives or misalign with the KPIs. As I’ve explained before, using simple volume or value-based targets doesn’t encourage the right kind of behavior or strategy for the long-term benefit of the DAO.

Also, we’re a team of independent professionals, each operating as a separate entity. The tasks we’re responsible for differ significantly in scope, responsibility, and influence on the final outcome. Splitting a variable income evenly would be inherently unfair, and designing a more nuanced system would introduce even more complexity.

On top of all that, fixing a percentage commission on ETH-denominated sales — with a target cash-out in dollars, converted to stablecoins, then to SAND, routed through an offshore Cayman account, and finally reconverted to euros and distributed to our respective companies — adds another layer of financial and operational friction. It becomes an accounting and compliance headache that could compromise both efficiency and transparency

This was exatly the tenur of Sebastien Borget concern on our meeting of thursday (he wasn’t there physically but those were the thing passsed on to me through note by Cyril) I understand where its coming from and I would love to meet you half way but I just can’t figure out how, I have made one proposition howerver : Setting up a Reserve price on some of the assets.